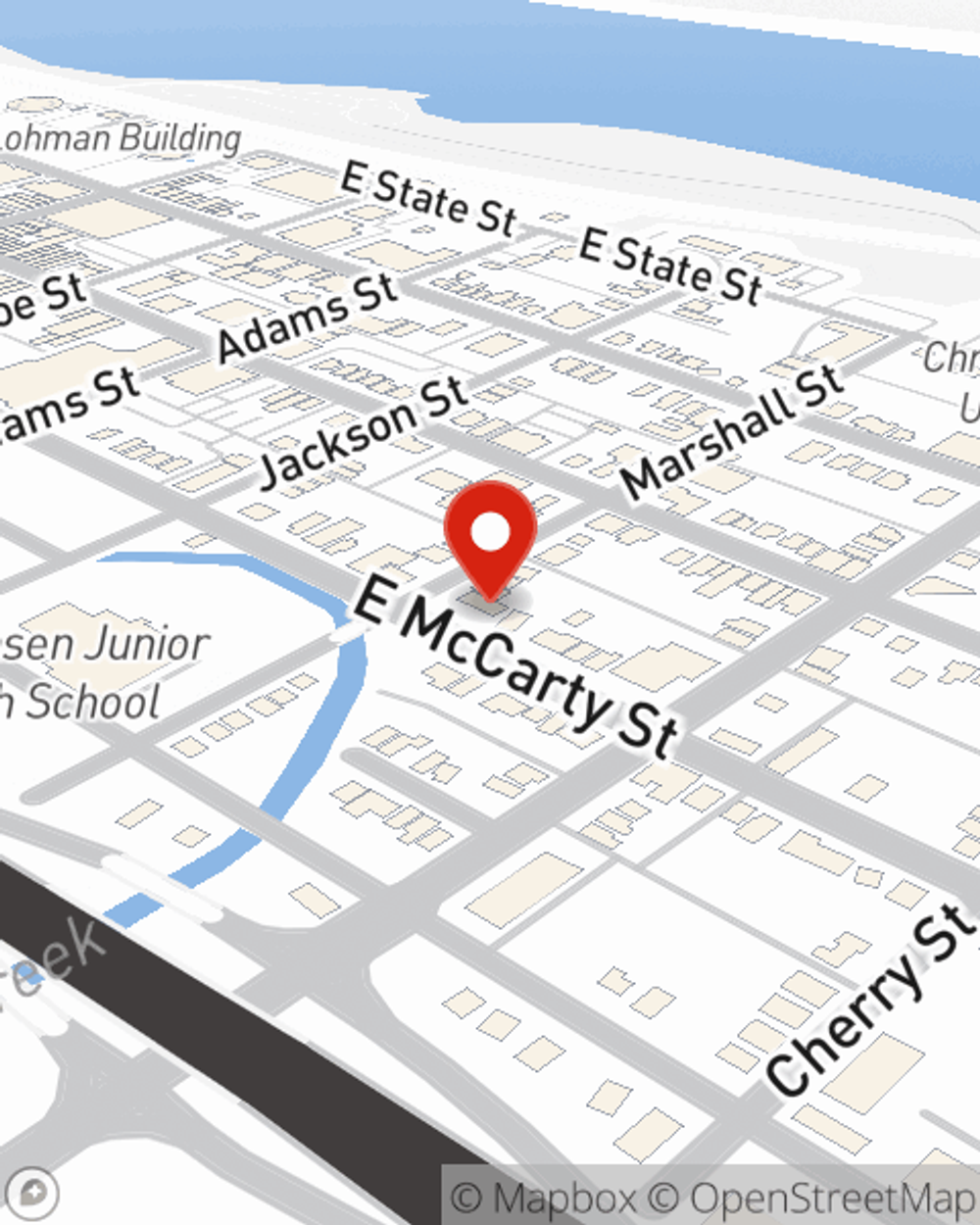

Renters Insurance in and around Jefferson City

Welcome, home & apartment renters of Jefferson City!

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

Your valuables matter and so does their safety. Doing what you can to keep it safe just makes sense! That’s why the most sensible step is getting renters insurance from State Farm. A State Farm renters insurance policy can cover your possessions, from your laptop to your hiking shoes. Not sure how much insurance you need? We have answers! Travis Smith is here to help you identify coverage needs and help secure your belongings today.

Welcome, home & apartment renters of Jefferson City!

Renters insurance can help protect your belongings

Renters Insurance You Can Count On

Renting a home makes the most sense for a lot of people, and so is getting insurance to protect your belongings. In general, your landlord's insurance could cover the cost of damage to the structure of your rented home, but that doesn't include what you own. Renters insurance helps protect your personal possessions in case of the unexpected.

There's no better time than the present! Call or email Travis Smith's office today to get started on building a policy that works for you.

Have More Questions About Renters Insurance?

Call Travis at (573) 636-9040 or visit our FAQ page.

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

Travis Smith

State Farm® Insurance AgentSimple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.